Pilot Project

With financial support from the Lucie and André Chagnon Foundation

Initiated and managed in collaboration with the Chantier de l’économie sociale

Maximum of $100,000 per enterprise*

Minimum of $10,000

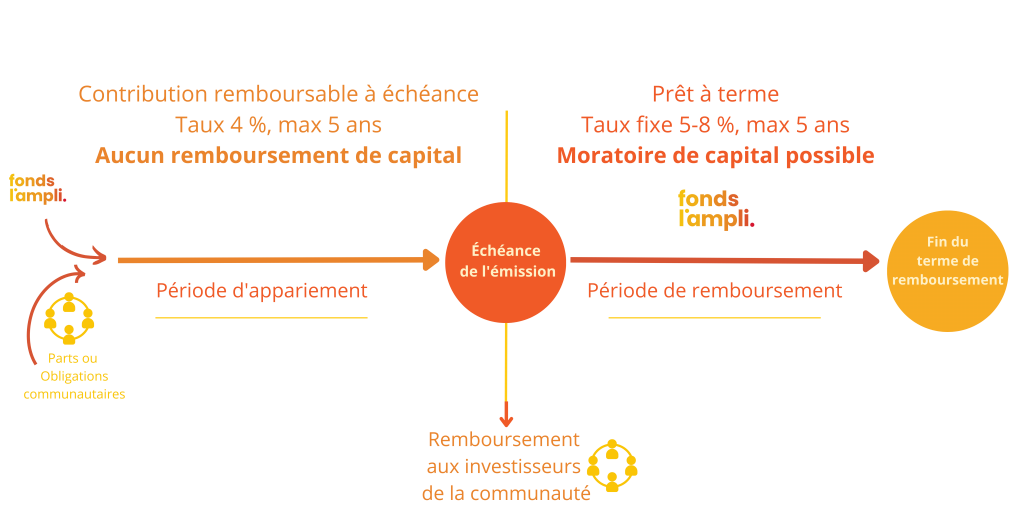

The Fonds l’ampli is a financing tool meant to accompany a community bond campaign or a social or preferred share campaign.

Its purpose is to encourage social economy enterprises and community organizations to use these types of participatory capital raising by matching investments made by the community.

With the goal of prioritizing repayment to community investors, the RISQ’s involvement would be converted into a term loan with the same repayment date as the preferred shares or community bonds.

Advantages

- Amplifies investments made by the community

- Improves the organization’s capitalization

- Solidifies community ties within collective projects

- Allows for community investors to be paid back first

- Extends the repayment horizon thanks to the conversion into a term loan

*As it is a pilot project, the exact parameters of the Fonds l’ampli may vary.

OBJECTIVES

- Solidify enterprises’ capitalization

- Foster community ties within Quebec’s social economy enterprises

- Support the emergence of new social economy projects

- Support existing social economy enterprises in their development

CHARACTERISTICS

- Financing tool to accompany a community bond campaign or social or preferred share campaign

- Dollar-for-dollar matching up to maximum authorized investment total

- Maximum of $100,000

- Without guarantee

- Matching loan

- Maximum term of 5 years

- Capital payment moratorium during the matching period

- Fixed interest rate for the matching period of 4% prior to repayment date

- Monthly interest payments throughout the matching period

- Conversion into a term loan

- Conversion following the matching period

- Investment term from 2 to 5 years

- Interest rate between 5% and 8%

- Fixed monthly payments (capital and interest) throughout the loan term

- Possibility of a capital moratorium

- Possibility of advance capital repayment with no penalty at any time with at least 90 days’ written notice.

- Commitment fee: 1.5% of the authorized amount

- An application fee of $200 is deducted from the commitment fee

Diagram of Fonds l’ampli Involvement

ELIGIBLE PROJECTS

- Enterprises that wish to organize a community bond campaign or social or preferred share campaign, including those in the start-up, development, expansion, consolidation or recovery phase

- Enterprises receiving support from the Ampli support ecosystem. For more details, visit the Ampli website – Participatory Finance Resources

- Campaigns carried out up to 6 months prior to requesting RISQ financing

- Matching only for the portion of community bonds or shares purchased by community actors (individuals or organizations), members or non-members.

ELIGIBLE EXPENSES

- Working capital

- Expenses related to development, including

- Professional fees

- Expert fees

- Other fees incurred for consulting or specialist services (e.g., to conduct studies)

- Capital expenditures, such as

- Land

- Building(s)

- Equipment and machinery

- Vehicles

- Incorporation fees

- Stock expenses (eligible if accompanied by a value estimate from a recognized independent expert)

- Any other expenditure of the same nature

- Technology, software or software package or patent acquisitions, or any other expenditure of the same nature.

INELIGIBLE EXPENSES

- Shares or bonds purchased by institutional investors (public sector, financial institutions or other investment funds)

- Expenses intrinsically related to organizing a traditional capital raising campaign;

- Debt, share or bond refinancing.

- Exclusions determined by the RISQ as listed on the Eligibility page

SUBMIT AN APPLICATION

STEPS

- Contact our team to determine whether your project is eligible.

- Send us your DOCUMENTS required to open your account, including the application and payment of the $200 application fee

- Your application is studied by a RISQ financial analyst / Discussions with project organizer and support team

- The financial analyst produces a report

- Your application is presented to the investment committee. Following the committee’s decision, its members will make a recommendation to the Board of Directors whether the application should be accepted or denied, or, occasionally, amended.

- If accepted, investment offer signed by the enterprise

- Validation that all conditions listed in the offer have been fulfilled and loan disbursement

- Oversight from the RISQ until full repayment of the loan.

DOCUMENTS

For a matching funds application, social economy enterprises must:

- Fill out and send in the signed form

- Pay the application fee (if applicable)

- Provide all documentation needed for application evaluation (see list below)

- Community bond or preferred share certificates for matching. For community bonds, certificates must include a clause informing investors of the risks associated with this investment (as per article 38 of the Cooperatives Act of Quebec).

- Legal notice of the campaign’s conformity with the exceptions from the Authorité des marchés financiers prospectus, issued by a lawyer and verified by the Chantier de l’économie sociale.

- Letter from a certified Ampli support network member

- Copy of letters patent (NPO) or Charter (co-op)

- Copy of general by-laws (including borrowing by-law) or internal governance by-laws.

- Resolution from the organization designating the application signatory

- Copy of the most recent annual report

- Copy of the past two years’ financial statements

- Recent interim financial statements (including accounts receivable and payable reports)

- Financial statements from affiliated enterprises (if applicable)

- Operating budget and financial projections

- Quotes (if applicable)

- Copy of confirmations from financial partners (if applicable)

- Other relevant documents: market research study, letters of support, etc.

Additional documents may be required to complete the evaluation of your loan application.